Image

Scams are increasingly sophisticated, and even the most cautious people can fall victim. When it happens, quick action can limit the damage and, in some cases, help you recover lost money. This article breaks down the Federal Trade Commission’s (FTC) guidance into a clear, community‑friendly resource.

Check out what’s going on in your state or metro area by visiting ftc.gov/exploredata.

Understanding the Situation

Scammers use phone calls, emails, texts, and social media to trick people into sending money or sharing sensitive information. If you realize you’ve been scammed, acting fast is essential—whether you paid a scammer, shared personal information, or allowed access to your device.

1. If You Paid a Scammer

Your next steps depend on how the payment was made. In every case, contact the company or financial institution immediately and report the transaction as fraudulent.

Credit or Debit Card

Unauthorized Bank Transfer

Gift Cards

Wire Transfer (Western Union, MoneyGram, Ria, etc.)

Money Transfer Apps (Venmo, Cash App, Zelle, etc.)

Cryptocurrency

Cash Sent by Mail

2. If You Gave a Scammer Your Personal Information

Username and Password

3. If a Scammer Accessed Your Computer or Phone

Remote Access to Your Computer

Control of Your Phone Number or Account

4. Report the Scam

Reporting helps the FTC track patterns, build cases, and warn others.

Report scams at:

👉 ReportFraud.ftc.gov

You can also explore scam trends in New Jersey and nationwide at:

👉 ftc.gov/exploredata

Why Reporting Matters

Even if you can’t recover your money, reporting:

Final Thoughts

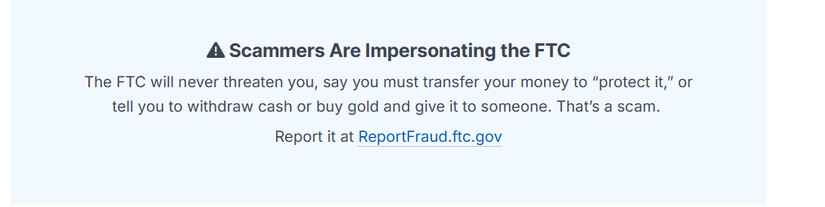

Being scammed can feel overwhelming, but you’re not alone—and quick action can make a meaningful difference. The FTC emphasizes that they will never threaten you, demand money, or instruct you to move your funds to “protect” them. Any such message is a scam.